Deb Cooperman sells cookware and teaches an occasional cooking class. She works part-time, so she’s opted for a health savings account and a high deductible health insurance policy. She can window-shop on Covered California if she has an HSA? Video by Brian Myers, Media Arts Center San Diego.

By Megan Burks

Second Opinion is a weekly Q-and-A series that answers questions from San Diegans on the Affordable Care Act. Ask yours here.

The Question: Does Covered California offer plans that are compatible with health savings accounts?

Deb Cooperman lives in La Jolla and works at Great News! Cookware and Cooking School. Her part-time schedule there means at least two things: She bakes a mean cookie; and she had to shop the individual market for health insurance.

Cooperman opted for a health savings account, which is a tax-advantaged account similar to a 401(k) or an IRA, except individuals withdraw from it regularly to cover health expenses. It has to be buttressed with a high-deductible health insurance policy.

Cooperman wants to know if she’ll find an HSA-compatible plan on the state’s insurance exchange, Covered California.

Here’s her question:

“My question is, I have an HSA, which is a health savings account. With the health savings account, you need to have a high-deductible plan. Can I get that under the Affordable Care Act?”

The Takeaway: HSA users can shop on Covered California, but not all plans are HSA-friendly.

The federal guidelines on HSAs say say you must have a high-deductible insurance policy to complement your account. The IRS decides how high each year and for 2014, it wants the deductible to be at least $1,250 for an individual and $2,500 for a family.

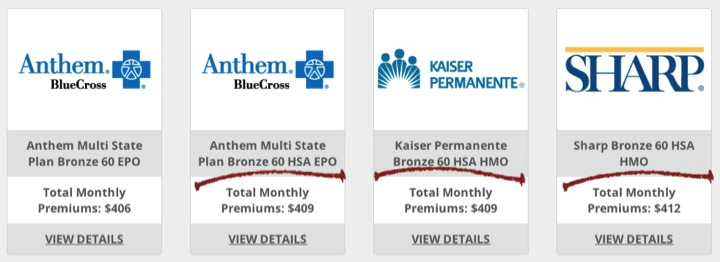

You’ll find plans that satisfy the IRS requirement in both the individual and small business sections of the exchange. They’re typically bronze-level plans and they’ll be labeled HSA-compatible at the top, where you’ll also see HMO and PPO designations. Make sure you’re looking there and not just at the deductible.

These plans do come with subsidies if you’re eligible.

The Orders: Start window-shopping (and take note of some changes to HSAs under Obamacare).

Many of the high-deductible plans that cover people with HSAs are grandfathered into the Affordable Care Act. That means they may not perfectly comply with the law but were in existence before it was passed in 2010.

Once you leave a grandfathered plan, you can’t get back in, so make sure you do some thorough window-shopping before switching plans. And take note of some recent changes to HSAs. They could impact your decision.

The health reform law says you cannot use an HSA to purchase drugs without a prescription, unless it’s insulin. It also upped the penalty for non-medical spending from 10 percent to 20 percent.

And something the law did not change for HSAs: coverage for dependents. HSAs do not cover kids until age 26 like most plans now do. They’re cut off at age 24.

Check out last week’s Second Opinion: Do Student Health Center Fees Satisfy the Individual Mandate?